Michigan Financial Planning for Retirement and Beyond

We are a Michigan Financial Planning Company that works exclusively with retirees and those of you who are nearing that phase of life. We don’t work with anyone else. Perspective clients have a minimum of $500,000 of investable assets.

We are a Michigan Financial Planning Company that works exclusively with retirees and those of you who are nearing that phase of life. We don’t work with anyone else. Perspective clients have a minimum of $500,000 of investable assets.

What we do is plain and simple

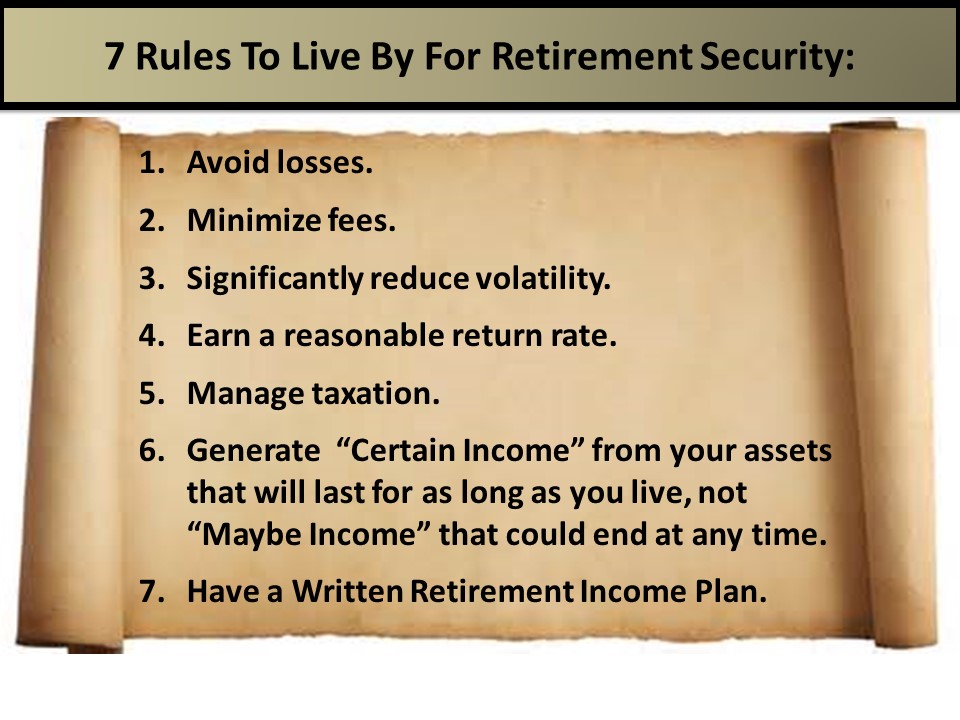

Whether it is over the phone, via the internet, or in person, if you are retired or nearing retirement, you’ve got to:

- Reduce your risk.

- Cut your fees.

- Maximize income.

- Guarantee your income is going to last as long as you live.

- Have that entire plan in writing.

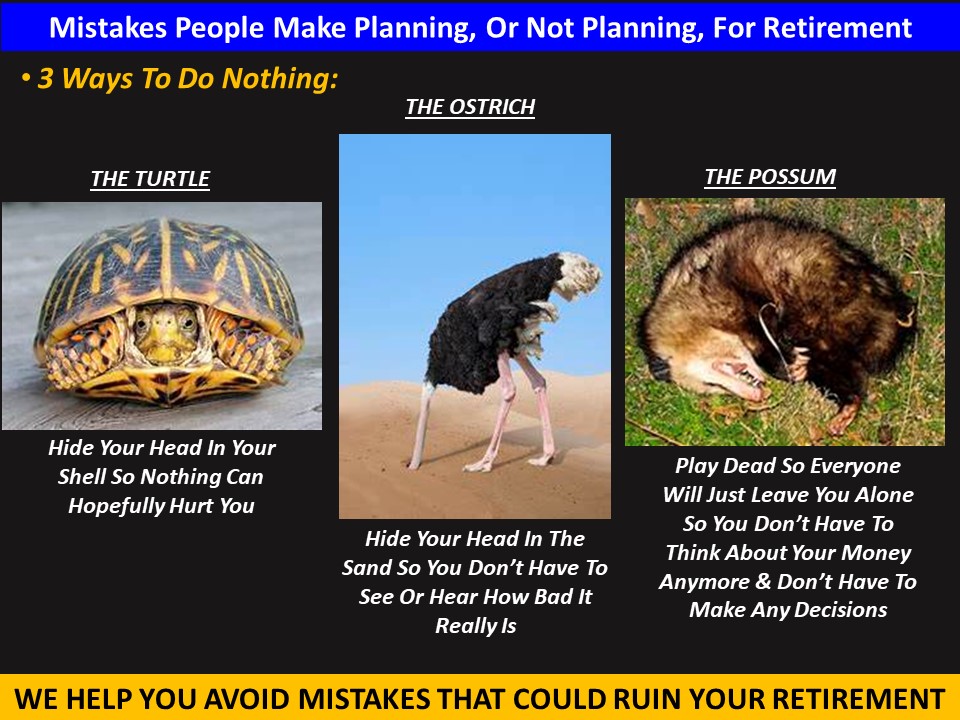

Why you are here

You are probably currently handling your finances one of two ways:

- You are doing everything yourself and recognize you need some help handling some or all of your money.

- You have another advisor you like who created a great deal of wealth for you over the year you were working, but are concerned that advisor is not the right advisor for the rest of your life, during your non-working years.

And you are probably tired of hearing things like:

- “Don’t worry, ride it out; the market will come back.”

- “We will just keep investing the same way we always have, and take money out as you need it.”

- "You must be in the market to have a successful retirement."

Changing Uncertainty into Certainty

You may be wondering if you can and should retire now. Our Income For Life software is designed to show you a way to retire sooner and stay retired. You can make an informed decision based on math, science, and facts, not opinions, estimates, and guesswork. You should never make an important once-in-a-lifetime decision based on maybes and pie-in-the-sky projections.

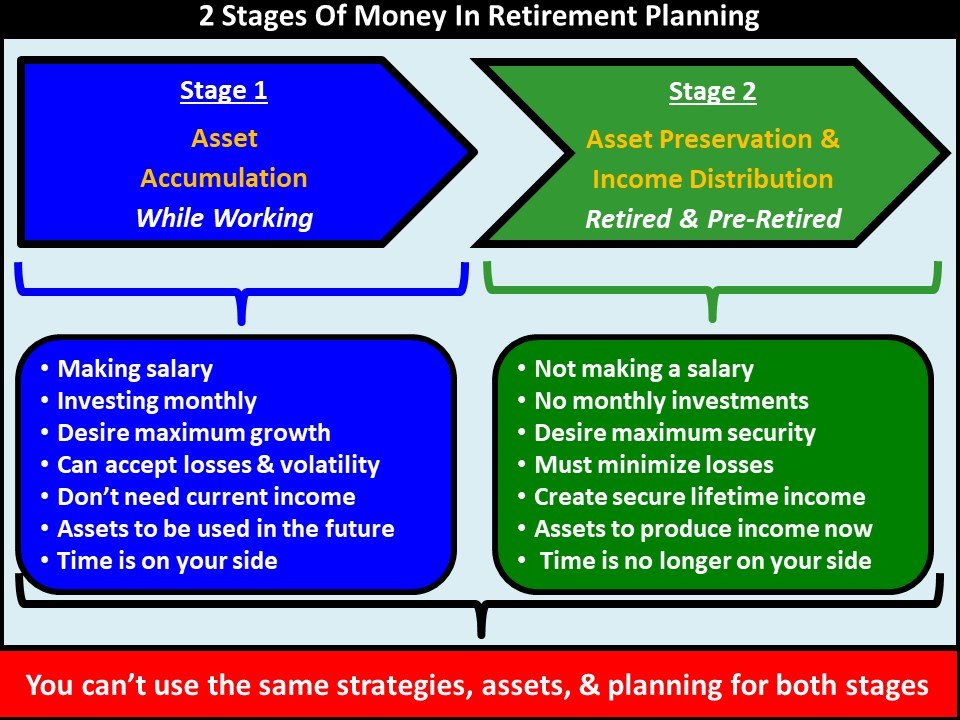

Objective Advice for both stages of life

Accumulation Phase

It’s about assets, not income. While you are working you want to accumulate as much wealth as you can.

Distribution Phase

It’s about income, not assets. When you are retired and not working, you should have a lifetime of income and not run out.

Anywhere and Anytime

As a Michigan financial advisor, we provide our clients independent objective advice to retirement and beyond. We can meet you anywhere you have access to an internet connection or by phone. Wherever you're comfortable, at home, at work, on vacation or even in person, we make it easy for you to get the strategies and coaching you deserve!

Does this sound familiar?

Your current Michigan financial advisor:

Your current Michigan financial advisor:

- Has created a great deal of wealth for you over the years.

- Provided some financial planning.

- Gives you a couple of meetings a year.

- Has an occasional phone conversation with you.

But what you want is:

Specific financial advice about everything you need to do in order to achieve all your financial goals.

Specific financial advice about everything you need to do in order to achieve all your financial goals.- To know whether you are on track or off track and what you should do to get on track or stay on track if you are not on track.

- Your family to be fully prepared for everything that could impact their money.

- Answers to questions in simple and easy-to-understand terms.

- A written retirement income plan.

It's your lifestyle

Our clients are financial delegators who let us handle all of their financial “stuff.” You have better things to do than worry about what’s happening on Wall Street. They are comfortable with our way of doing business and how we are compensated.

Our clients are financial delegators who let us handle all of their financial “stuff.” You have better things to do than worry about what’s happening on Wall Street. They are comfortable with our way of doing business and how we are compensated.

Your financial objectives are unique.

Your decades-long journey to a well-funded retirement through wealth accumulation requires you to hopefully head steadily down the road to financial success, even when the pavement has potholes. Therefore, we help our clients:

Your decades-long journey to a well-funded retirement through wealth accumulation requires you to hopefully head steadily down the road to financial success, even when the pavement has potholes. Therefore, we help our clients:

- Focus on their time horizon.

- Follow facts, not emotions.

- Gradually make adjustments.

This is the time in your life that it’s not so much about what you earn, but about what you get to keep. Ultimately, in retirement, it’s not what you make; it’s what you get to spend.

It's No Longer About the Size of Your Stack of Cash

Spending money is what you do in retirement. The trick is not to overspend early on and run out of money later in life when you need it the most. Would you board a plane that has a ninety percent (90%) chance of making it to its destination? Of course not. But you probably want to board retirement with a one hundred percent (100%) chance of landing safely at your journey's end.

Your Michigan Financial Advisor Needs New Skills

The skills and strategies used to accumulate money are very different from those utilized when planning to spend it in retirement. The earlier in life you plan for your retirement lifestyle, the better off you can find yourself in retirement.

The skills and strategies used to accumulate money are very different from those utilized when planning to spend it in retirement. The earlier in life you plan for your retirement lifestyle, the better off you can find yourself in retirement.

To Meet New Challenges

Retirement presents new challenges for you to navigate like:

Retirement presents new challenges for you to navigate like:

- When to take Social Security.

- Medicare and rising health costs.

- Inflation.

- The sequence of return risk.

- Having enough income to see you through it.

What retirement is really about

The success of your retirement is not about assets or how big your 401(k) is. You may have been told the bigger the pile of money, the better your retirement will be. In retirement, it's no longer about how much you saved, it’s about taking your life savings and:

- Converting part of it into an inflation-protected spending plan to support your retirement lifestyle.

- Adapt the balance into a professionally managed retirement plan.

It’s the proper management of income and wealth that makes for a fulfilling retirement

Here at the Wealth & Income Management Group, we focus on helping in helping our clients retire successfully and want to work with you for the long term. We’re looking for clients who are a good fit, and we can help them live their dream retirement. In addition, we do not offer a one-size-fits-all, cookie-cutter approach.

How we are compensated

We have found that in order to be a good fiduciary, we need to offer both fee-based and commission-based products when appropriate to complete your retirement plan. We do not try to force a square peg into a round hole like many of our competitors do. After you understand your choices, it will be up to you to decide which is appropriate. We believe that an advisor who offers one without the other is only doing half the job. Above all, we see our job as presenting you with products, solutions, and ideas you might not have thought of on your own.

What’s keeping you up at night?

You should not be losing sleep worrying about things like:

You should not be losing sleep worrying about things like:

- Stock market volatility and outside economic problems affecting your retirement.

- Rising inflation, taxes, and future healthcare costs.

- The current performance of your portfolio.

- The growing federal deficit.

If any of these things are keeping you up at night, contact us, and let’s talk.

In Conclusion

Albert Einstein's definition of insanity is doing the same thing over and over yet expecting different results. You can keep doing the same thing, keep risking, keep worrying, and/or keep going without. Or you can get a second opinion, protect your money, increase income, and reduce fees, then feel secure and enjoy life.

Albert Einstein's definition of insanity is doing the same thing over and over yet expecting different results. You can keep doing the same thing, keep risking, keep worrying, and/or keep going without. Or you can get a second opinion, protect your money, increase income, and reduce fees, then feel secure and enjoy life.

We will meet with you one-on-one, find out where you are at, meet with you as many times as needed, ask you what you want to happen, and not charge you any fees to meet. We will design an actual written plan for you, reduce risk by protecting against large losses, create a dependable lifetime income plan, earn competitive returns, help you understand your money, create your financial freedom, and help you stop worrying about your money. It is all about what is important to you.

So here are your Next Steps

So here are your Next Steps

If we haven't already met, please schedule a time using the on-line calendar for an introductory phone call or send us an e-mail. We will treat you politely and like a professional, with no pressure. We don't like to be pressured to buy anything, and neither should you. You are under no obligation to work with us. As a result, what we do after the initial call is up to you. It is important to get the facts before you make any long-term decision.

This site is published for residents of the United States and is for general educational and informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security or financial product that may be referenced herein. The content is developed from sources believed to be providing accurate information. None of the information presented is intended to give you specific tax, investment, real estate, legal, estate, or financial advice but rather to serve as an educational platform to deliver information. The ideas, thoughts, and strategies presented here are those of the Management Team and provide an insight to our views on the Wealth & Income Management Group, LLC. Some of this material was developed and produced by the Wealth & Income Management Group to provide information on a topic that may be of interest. Every detail in this website is subject to change without notice.

2nd Opinion Package available to Qualified Retirees and Soon-To-Be-Retirees may include free consultations, a free retirement income plan, risk analysis, and fee analysis. In addition, a comprehensive written retirement income plan may be provided to those who complete the entire process. Qualified Retirees and Soon-To-Be-Retirees must have a minimum of $500,000 of investible assets such as IRA’s, 401K’s from past employers, stocks, bonds, mutual funds, bank accounts, money markets, CD’s, etc., but DOES NOT include real estate, businesses, limited partnerships, 401K/retirement plans that can’t be moved to another plan, and other illiquid type assets.

Past performance is no indication of future performance and such information cannot be relied upon regarding future potential gains. Investing involves risk. There is always the potential of losing money when you invest in securities. Asset allocation, diversification, and rebalancing do not ensure a profit or protect against loss in a declining market. Advisors mentioned on this website may only offer services, transact business and/or respond to inquiries in states or jurisdictions in which they have been properly licensed and registered or are exempt from registration. Not all products and services referenced on this site are available in every state, jurisdiction, or person listed.

Nothing is directly or indirectly guaranteed by this information. The planning and ideas presented herein are not suitable for all individuals or situations. Hypothetical examples are used to explain concepts and are not indicative of potential results you could receive; past performance is not a guarantee of future results; and results are not indicative of any particular investment or income tax situation; your results will be different and could be lower or higher. Please consult legal or tax professionals for specific information regarding your individual situation. The Wealth & Income Management Group does not offer tax or legal advice. Consult your financial professional before making any investment decision.

Insurance product features and benefits, such as guaranteed lifetime income riders, are subject to contract terms, limitations, fees, and the claims paying ability of the insurance company issuing the contract. The sale or liquidation of any stock, bond, IRA, certificate of deposit, mutual fund, annuity, or other asset to fund the purchase of any other asset, including an annuity, may have tax consequences, early withdrawal penalties, or other costs and penalties as a result of the sale or liquidation. Different assets can be complex and carry fees, costs, and surrender charges. If you place assets under management with the Wealth & Income Management Group LLC, we are paid an advisory fee from Brookstone Capital Management, LLC, and if you purchase an annuity through us, we are paid commissions from an insurance company.

Wealth & Income Management Group, LLC, is a financial planning and umbrella marketing organization, which enables the provision of multiple financial services under one brand. Investment advisory services are offered through Brookstone Wealth Advisors, LLC (BWA), a registered investment advisor. Registered Investment Advisors and Investment Advisor Representatives act as fiduciaries for all of our investment management clients. We have an obligation to act in the best interests of our clients and to make full disclosure of any conflicts of interest, if any exist. Please refer to our firm brochure, the ADV 2A item 4, for additional information.

BWA and Brookstone Capital Management, LLC are affiliated companies. BWA and the Wealth & Income Management Group are independent of each other. Insurance products and services are not offered through BWA but are offered and sold through individually licensed and appointed agents. This site is maintained by the Wealth & Income Management Group, 425 West Huron Street, Milford, Michigan 48381 | (810) 626-5101.

Through downloads or other computer links, you may gain access to other third-party material from the internet, or sites on the internet, which are not part of this site. In conclusion, the Wealth & Income Management Group is not affiliated with any such third parties and is not responsible for the privacy practices or the accuracy of the content of such material or websites.